SHANGHAI, Feb 18 (SMM) – Transportation activity in coastal provinces has started to return to near normal levels in recent days, but that inland remains more restricted. Overall economic activity remains muted due to the 14-day self-quarantine rules in most cities which are limiting the ability of factories and construction to restart. However, in most areas this activity is expected to resume in coming weeks and overall confidence in future demand remains solid, especially with the government sending out supportive messages towards economic support.

It remains too early to say whether there is any significant aggregate demand loss, but clearly inventory is rising for most metals, especially at producers. However, inventory always rises post CNY ahead of demand going into its strong season, and hence so far few market players are interpreting the inventory build as bearish.

Please see below for more details on the impact to each metal, and don't forget to join our webinar on the latest impact from the virus, and a deep dive into the ferrous metals market (steel and iron ore), tomorrow (February 19) at 5PM China time. Book your slots by following this link https://register.gotowebinar.com/register/1659228322246787596

Transportation

Transportation has recovered significantly as the COVID-19 epidemic has gradually been controlled and the government issued policies to encourage transport resumption. 50%-80% of transport has resumed, as SMM surveyed.

Liaoning: 70%-80% of motor transport has recovered, but trans-province transport has been slightly restricted. Marine transport has returned to normal.

Hebei: Motor transport has basically recovered but there is a lack of drivers. Marine transport has gradually resumed as ports of destination have started to receive cargoes.

Henan: Less than 50% of transport has recovered due to lack of drivers and vehicles.

Hubei: Steel transport has not recovered.

Shandong: Motor transport in the province has basically resumed, but trans-province transport needs permits. Marine transport has partially recovered as capacity of ports of destination was limited.

Guangdong: 80%-90% of motor transport has resumed. Loading and unloading of cargoes at warehouses and docks have returned to normal.

Warehouses

Warehouses in east, south and north China have resumed, and cargoes at ports have been transferred to warehouse. However, slow depleting of stocks resulted in shortages of storage capacity of warehouses.

End-users

Manufacturing: Resumption at manufacturing end-users missed expectations and diverged in different regions. Enterprises in Guangdong, Henan, Zhejiang, Hunan, Anhui and Jiangsu where the epidemic was serious remained closed. Some employees worked from home, and purchasers started to contact traders for raw material purchases. Less than 50% of manufacturing in other regions less affected by the epidemic has resumed operations as workers need to be quarantined for 14 days before returning to work.

Automobile manufacturing in Hubei and Hunan, the two major automobile manufacturing provinces, was basically muted amid the COVID-19 outbreak, which had a great impact on general resumption in the automobile sector. Enterprises in Jiangsu and Zhejiang, major home appliance manufacturing provinces, resumed slowly, which slowed down recovery in the home appliance sector.

Construction: Outdoor construction and complex personnel structure increased the risk of infection for workers in the construction sector. Major projects and projects related to people’s livelihood were allowed to resume during February 15-24, later than other sectors. Many local governments required house construction projects not to resume before March 1. Although major projects in Hunan and Henan were approved to resume, less than 20% of them has recovered as workers need to be quarantined for 14 days before returning to work. Most house construction projects are likely to resume in the first half of March.

Iron Ore

Operations at miners have recovered in many areas, but there remain some mines that are expected to resume no earlier than the second half of February, due to the required quarantine of newly-returned workers, a move aimed to contain the coronavirus.

SMM forecasts the virus outbreak to affect the supply of domestic iron ore in major production areas by 1.5 million mt in February. Inventories at mines rose significantly on the continued transportation restrictions in many regions, despite the gradual recovery of motor traffic.

Iron ore production in Liaoning is expected to fall 2.4% in February on COVID-19 impact. Miners in Liaoning recovered operations successively from February 12 as the province did not badly hit by the virus. But some mines planned to delay their resumption till the end of the month. Shortage of raw ore drove some mines to scale back operations, or carry out staggered production, weighing on the average operating rates to only 50%. Some mines recovered mining operations on February 17, but ore dressing remained suspended. Steel mills told SMM that shipments of domestic ore have resumed 70-80%, but trans-provincial delivery still faces restrictions.

The COVID-19 impact is likely to reduce iron ore production in Hebei by 2% in February. In Tangshan, the city that was severely hit by the virus, suspended miners extended their holidays as of February 17 and mines in operations kept only half of their capacity running. The failure of recovery for mining workers in Qinhuangdao put some ore dressing plants into suspension. Production at mines in Chengde was basically normal with less impact from the virus. Most mines in Handan, meanwhile, halted operations before the CNY holiday, and may unlikely to recover before the annual political sessions in China, which are scheduled in early March but likely to be postponed due to the epidemic.

Iron ore output in Shanxi is estimated to fall 4.8% in February. Only a handful of miners resumed operations on the previously scheduled February 10, and most producers will recover in the second half of the month as the epidemic prevents the returning of workers. Some state-owned mines continued to produce during the CNY holiday, but kept the operating rate only at 80%. Cargo shipments partially recovered but restrictions remain in place in some areas of Shanxi. For instance, continued curbs on trans-provincial delivery impacted the shipments of fine ore from Daixian County to Handan.

The virus outbreak is expected to reduce iron ore production in Inner Mongolia by 1.1% this month. Major mines in Inner Mongolia maintained normal operations, except that some mines shut down for maintenance from end-December and may recover in March on the back of unfavourable weather. Small mines and mines invested by businesses from other provinces have remained shut since the CNY holiday, and transportation curbs have not been lifted in Inner Mongolia.

Output at mines in Shandong is expected to fall 6.3% in February as most mines resumed on February 10. The Ministry of Economy and Information required mines to resume normal production while the epidemic prevention department required that mines must take proper epidemic prevention and control measures. Production is likely to recover faster than in other regions as most of the mining workers are from Shandong.

Output at mines in Anhui is expected to decline 4.9% in February due to the epidemic. Mines in Huoqiu are producing normally, while mines in Lujiang began to resume on February 10. Explosives shortages may affect production as explosives suppliers have not yet resumed. Some mines are unable to resume as their mining licenses have expired.

Output at mines in south-west China (Sichuan and Yunnan) is expected to decrease 2% in February due to the epidemic. Mines in Liangshan, Sichuan were not allowed to resume before February 20, given the severe epidemic. Production at mines in other regions was little affected as most of the workers are locals. Poor sales prompted steel mills in south-west China to undertake maintenance, weakening demand for iron ore. This, combined with restricted transport by truck, pushed up inventories at mines.

In other regions, mines in Hubei remained shut as the epidemic was the most severe there. Mines in Henan reported low operating rates as people that travelled between provinces must be self-quarantines for 14 days. Operating rates at a state-owned mine stood at just 20%.

In Guangdong, some mines resumed on February 14, but operated just half of the capacity due to manpower issues. Transport by truck is gradually recovering, but vehicles and drivers from regions where the epidemic is severe remain restricted.

In Fujian, some mines have resumed. Mining activities are unlikely to recover significantly until next week as workers from other provinces must be self-quarantines for 14 days. Beneficiation plants have basically resumed full production.

Mines in Jiangsu resumed on February 10, but concentrates were sold locally due to restrictions on transport between provinces. Production restrictions at steel mills muted trades.

Rebar/Steel

China’s inventories of construction steel rebar extended their increase this week, primarily due to a loss in demand amid a coronavirus outbreak. The inventory growth also accelerated as cargoes previously in transit had arrived at warehouses with the gradual recovery of logistics. But demand will likely to recover soon as some major projects in the market had shown signs of resuming construction, SMM learned.

The increase in rebar social inventories was significantly slower than the inventory buildup at steelmakers, as some transportation curbs remain in place. Most steel plants reported greater inventory pressure and insufficient storage capacity, and some were compelled to scale back output or underwent maintenance.

Rising inventories continued to keep spot prices of rebar under pressure, but the downside potential will be limited as market participants await the release of pent-up demand with the recovery of logistics. According to SMM data, rebar inventories at Chinese steelmakers stood at 6.2 million mt as of February 13. This was up 22.7% from February 6, compared to a 20.1% rise last week. Inventories across social warehouses advanced 15.9% on the week and stood at 9.7 million mt, accelerating from a buildup of 11.3% in the previous week.

Overall inventories of rebar, including stocks across steelmakers and social warehouses, increased 18.5% and posted 15.91 million mt as of February 13, after an increase of 14.5% in the prior week. On a yearly basis according to the lunar calendar, overall inventories were 21.1% higher as of February 13, following a buildup of 14.4% last week.

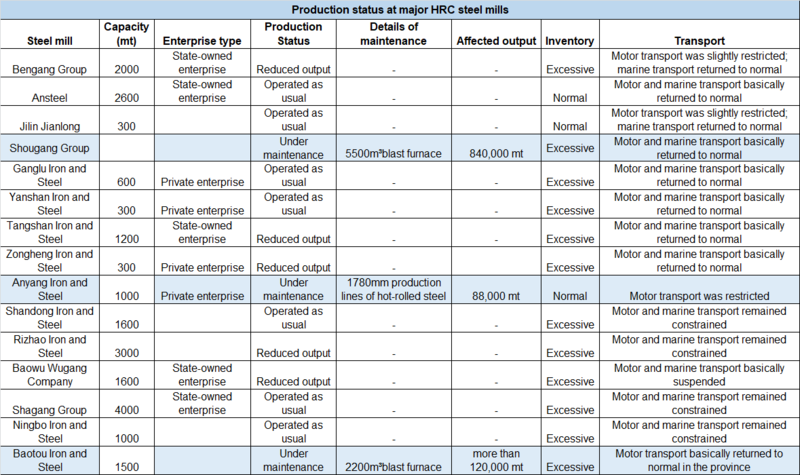

According to an SMM survey that covers 102 long-process steel mills, 67.65% of them operated as usual, and 32.35% conducted maintenance to reduce output (excluding mills that cut output by adjusting equipment utilisation coefficient and raw material ratio). Unrecovered end-user demand and shortage of storage capacity prompted more steel mills to undertake maintenance, which mainly had an impact on output of construction steel. 93.94% of steel mills under maintenance overhauled rolling lines of construction steel, and only 9.09% overhauled rolling lines of steel plate/sheet (Note: steel mills that overhauled rolling lines of both construction steel and steel plate/sheet were calculated repeatedly).

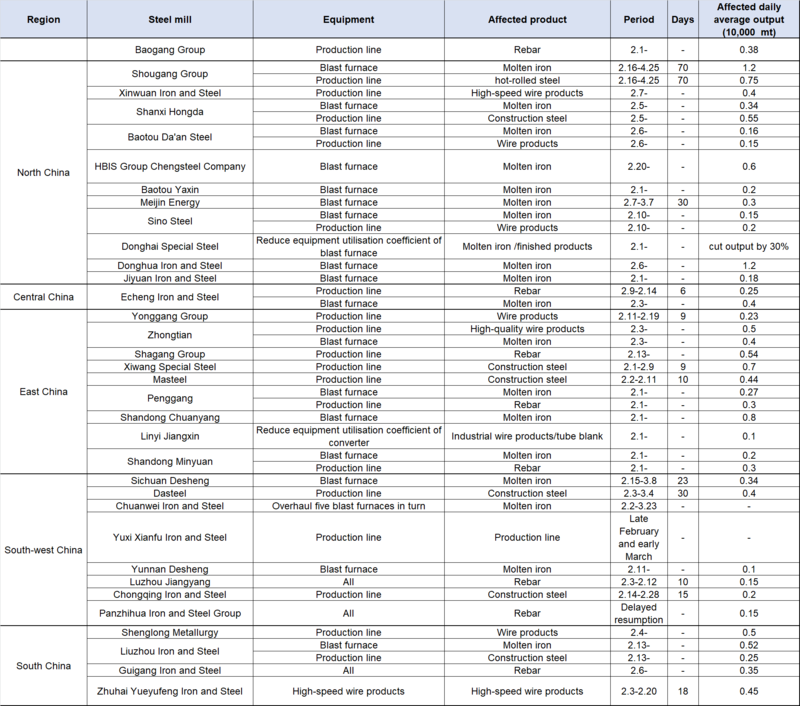

Chart 1: Production status at major HRC steel mills in China

Chart 2: Update of equipment and output at Chinese steel mills